From here to financial independence and early retirement in one straight line. From a FIRE wannabee to reaching real FIRE. Something like this:

Looks pretty straightforward right?

But what exactly is the greater goal? Why am I aiming for FIRE? My posts 5 things you can afford when you are financially independent and do you have what it takes to retire early, explain it all.

Money, money, money

To achieve financial independence I need…money. Obviously. But how much? When will I have reached my goal?

Something like this:

That’s a very rough estimate. How much I really need depends on multiple factors, like:

- When I will retire (early)

- What my future expenses will be

- My ‘retirement model’ (do I deplete my savings or not after retirement)

The above may change as I walk the line towards FIRE, but one thing is set in stone: I will retire before I turn 60.

The details

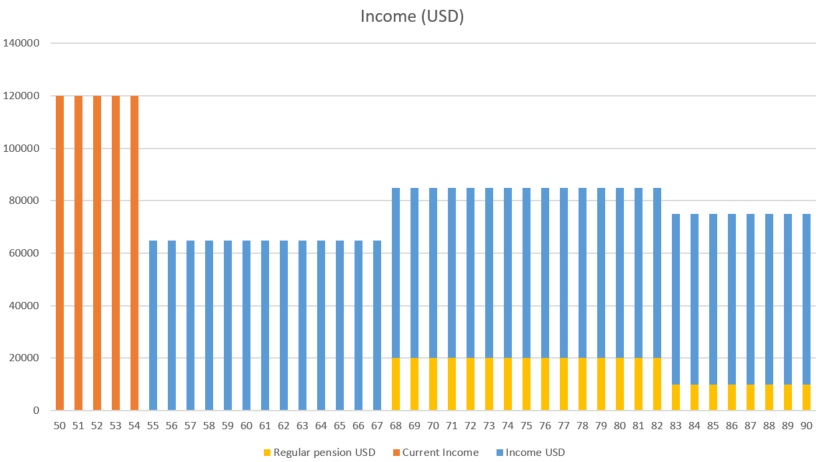

First, let’s have a look at how things look if I don’t change a thing and work until I am 68 (which is when my pension payments start).

I have a good income and after the bills are paid and my stomach is full there is money left to spare. And until I hit 68 all is well. But then there is a pretty big drop. From one day to another my income (pension) will be less than 50% of what it was before. And another 50%+ drop will occur if I am lucky enough to reach 83.

I could do something about this. For one, I could start paying higher contributions for the remaining 18 years. I could also sell my mortgage-free home and get a cheap rental property. Or immigrate to a cheap(er) country.

There is just one problem. I want to retire early. Early as in before I hit the big 6-0. Working until I am 68 is exactly what I want to avoid. So something needs to be done.

Let’s have a look at a more preferred scenario below. Here I will retire when I am 55 and another income (blue bars) will bridge the gap between early retirement and the moment my full pension kicks in at the age of 68. In this scenario I would keep paying the pension contributions until I reach 68.

The decline in income from 54 to 55 is still fairly significant. However, the chart illustrates the minimum required income for financial freedom. Financial freedom is not the same as being wealthy. But mapping it out like this helps me to understand how much additional income I need to support at least a modest lifestyle.

Now, the plan is that my investments will generate a steady, life long income. That’s the scenario shown below:

I will stop paying the pension contributions from the age of 55, so my regular pension will be considerably lower (probably even lower than what is shown above). But there is no need. I will be able to live off my investments for the remainder of my life.

You could argue that if my pension is going to be relatively insignificant, why should I then keep paying contributions? Wouldn’t it be wiser to stop paying them and invest the money elsewhere in the hope to generate a better return? The thing is that my company pays 60% of my current contribution. If I opt-out I will also opt-out of the 60%, which doesn’t strike me as a good idea.

Living for less

Can I live for less than I do today? Absolutely. I wouldn’t necessarily embrace a minimalist lifestyle, but I’d be quite okay with reducing my post-retirement spending. This is not about being rich. It is about being free. And I am rather free with a modest lifestyle than tied to a job in order to finance more excessive wants.

What exactly defines a modest lifestyle? I think that’s in the eye of the beholder. What works for some doesn’t work for others. Below you see some of the numbers that I think will work for me.

So what exactly are the numbers?

I want my goals to be a) realistic and b) involve early retirement at the age of 55-56 (well 59 at the latest). I know that these goals may actually be mutually exclusive so let’s get our hands dirty and look at some numbers to see what is feasible.

First, let’s get an idea of where I am at now (September 2018).

| Mortgage-free home | $300K |

| Company shares | $60K |

| Liabilities | $31K |

| Net worth | $329K |

Bridging the years between early retirement and regular retirement

One possible approach to reach financial freedom is to focus on bridging the years between early retirement and full pension age. To do this I will need to cover the following:

- Pension contributions (voluntarily) – $15K

- Expenses – $60K

So that’s a total of $75K (or $900K for bridging 56-68). The pension contributions are quite high because I want to ensure the full pension is being paid by the time I reach 68.

But this is based on today’s price level. In 2024 (when I am 56) prices are up 15%. From 2024 to 2036 (when I am 68), prices will jump another 30% (assuming an inflation of around 2.5%).

If I apply the increasing price levels to the expenses, they will look like this:

- Expenses 2024 – $69K

- Expenses 2036 – $90K

The average expenses would be close to $80K.

If my pension contributions stay the same (not sure that’s wise) the total will be $95K (or $1.14 million for bridging 56-68).

Okay, so I need $1.14 million for surviving the 12 years from 56 to 68. After that I will live off my pension.

But do I really need that much if I can get my savings/investments to generate a decent return? For example, if I can get the money to generate a return of 4%, the following applies:

I would ‘only’ need $900K to bridge close to 12 years. I entered a monthly withdrawal of $8,000 as this is the monthly amount if I need $95K per year on average.

More accurately, I’d withdraw a little more each year (due to increased price levels). Something like in the chart below.

If we assume I sell my home when I am 56 (for let’s say $350K) and find a cheap rental place instead I ‘only’ need $550K more. I already have $60K in shares, so that means I actually need to save/generate $490K between now (October 2018) and 2024.

That’s a lot. It means $80K per year. It doesn’t actually mean I have to save that amount, as the money I save will generate a return that I will re-invest right away. If the return is 5% I will have to add an additional $60K annually to get close to the $490K.

$60K is still a lot. But better than $80K.

And now the big question comes. Can I achieve this? is it remotely possible to generate the required amount?

I need to be realistic. There are some flaws in the above. For example, my projected pension will hardly be enough with increased price levels. So I will need to save more in order to supplement my pension from age 68 and on-wards.

But if I can’t save more, I can reduce expenses. This is why I don’t lose hope at all. I would be willing (and able) to live overseas (that’s a metaphor) where price levels are considerably lower. I would also be able and willing to delay the early retirement. As long as I retire before I hit the big 6-0. The impact of 4 more years of saving and the reduced number of years I’d need to bridge from early retirement to full pension age would be really significant.

I made a quick calculation. If I retire in 2028 instead and have to bridge 8 years until full pension age, I would have to have around $650K. If I subtract the $350K for my home and the $60K I already have, I am left with $240K to save. As I have more years to do that (10 instead of 6), I would need to make sure the value of my portfolio increases with $24K per year. As the portfolio generates a return that I re-invest, saving less than $20K per year would actually be sufficient.

Now we are talking. That’s definitely not beyond the realm of possibility.

A steady life-long income

What I prefer is to have my assets generate so much return that it covers my expenses. Now and in the future. This would give an incredible peace of mind.

Let’s assume I manage to save $1 million before I hit 60. If I can get a 5% return on this, it would correspond to $50K annually. This would not be enough to cover my expenses in the long run, but it is a life-long income.

To be able to cover my expenses with increased price levels I think I will need $1.3 million. Because it would generate life-long income and I therefore wouldn’t really need to keep paying pension contributions until full retirement age, I would be inclined to settle for that.

$1.3 million in 10 years. That would only be possible with a 10%+ return and additional investment of $60K per year.

But it is not totally hopeless. Why? Because there is the expense side as well. If I can reduce my spending after early retirement, I would need to save less.

Control spending

Success does not only depend on how much return my investments generate but also on my ability to control my spending and expenses. Controlling (reducing) my spending and expenses is key to a) being able to invest as much as possible and b) being able to live off my investments later on.

Therefore, my plan has two sides. Generate income and reduce my expenses.

The expense side is at least as fascinating as the investment side. For the short term, it is mostly about reducing expenses related to short term pleasures (should I buy that new flat screen or keep the old one, expensive v. cheaper car, two holiday trips per year or just one, etc.). For the long run I am investigating some other options as well:

- Live considerably cheaper (new home, emigrate)

- Trash my car and use public transport (depends on the quality of public transport)

There are many other parameters I will be able to tweak and I will keep you posted. Inspiration for how to save money is as important as inspiration for how to let your money grow.

Is it realistic?

So why do I believe it can be achieved? I believe it because this isn’t gambling. There are risks involved, as with any investment, but also factors that I can influence. Some of those factors are related to simple discipline and perseverance. To learn, to think long term instead of short term, to control and reduce spending.

I am ready to start. Will you join me on my journey? Subscribe and you will receive a notification by email each time I post something new on the site.